Expat Investing: In Retirement, the Sequence of Returns Matters

By Chad Creveling, CFA & Peggy Creveling, CFA

Most people understand that markets go up and down from year to year. They also generally know that their portfolio will rise and fall over shorter periods, such as one year. Investors accept this short-term volatility because they understand that markets and portfolio values generally rise over the long run (assuming they can stay invested).

What is not well understood, however, is that the order of the up-and-down periods you encounter in retirement can have a profound effect on how long your portfolio will last. Over a 30-year retirement, you could average an 8% return while encountering one sequence of 30-year annual returns and have enough money to fund your retirement. You could also encounter another sequence of 30-year annual returns that averages 8% where you run out of money before the end of your retirement. How is that possible?

The Order of Investment Returns Matters

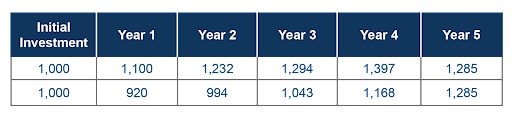

Most people focus on an average portfolio return over time without considering that there are many ways to achieve that average. The simple example below shows two 5-year return sequences that result in the same average. The second sequence is just the reverse of the first. In fact, there are probably an infinite number of five-year return sequences that could result in a five-year average of 5.4%.

If you invest a $1,000 lump sum, you can see that from year to year, the ending values for each sequence differ, but by the end of the five-year period, you have the same amount of money. For a lump sum investment, where there are no cash flows in and out of the portfolio, you have the same ending value. As long as the averages are the same, the pathways (return sequences) can differ, and you will end up in the same place.

The Outcome Differs for a Distribution Portfolio

The picture changes when you start withdrawing funds from the portfolio as you would in retirement. If you invest the same $1,000 as before, but withdraw $200 from the portfolio at the end of each year, you can see that not only do the yearly amounts differ, but the ending value is no longer the same. In the first sequence of returns, you have enough funds to last the five-year period. In the second sequence, you run out of money at the end of year four. The average investment return in both cases is still 5.4%.

The order of the returns matters when you are withdrawing funds from your portfolio. Why? Poor returns at the beginning of a retirement period combined with withdrawals quickly depletes the value of the portfolio and overwhelms its ability to recover, even when there are better returns later in the retirement period.

Return Sequences Affect How Long a Portfolio Lasts

In an article published in Financial Planning magazine, "Does the Sequence of Market Returns Matter?" Craig L. Israelsen looked at the impact of return sequence in detail. Starting with an initial balance of $100,000 and an initial $5,000 withdrawal that increased 3% per year, he looked at investing the initial amount in each of 12 separate asset classes using the actual returns from January, 1, 1998, to December 31, 2012, and then reversing the return sequence to see the effect on the portfolio. He additionally looked at a number of randomized return sequences drawn from the actual returns of each asset class during that period. In each sequence, the average was the same; only the order of the returns differed over the 15-year period.

Israelsen did the same experiment for a balanced portfolio of 60% U.S. large-cap stocks and 40% U.S. intermediate-term bonds and for a portfolio equally weighted among each of the 12 asset classes.

The results:

- The difference in ending portfolio values was the greatest (meaning the sequence mattered the most) for the most volatile asset classes. This was particularly noticeable with the emerging markets and real estate asset classes.

- The sequence of returns had the least impact on lower-volatility fixed-income asset classes.

- Surprisingly, cash was very sensitive to the return sequence. Low returns on cash (such as we are seeing now) at the beginning of a retirement period could not support inflation-adjusted withdrawals, making it difficult for the portfolio to recover.

- The 60/40 portfolio and the 12-asset-class portfolio showed minimal variations in ending values. Diversification lowered the volatility of returns, which reduced sequence risk.

Some key points:

- The sequence of returns matters for retirement portfolios with systematic withdrawals.

- The more volatile the portfolio, the more the return sequence matters.

- Diversification, as demonstrated by the 60/40 and 12-asset-class portfolios, lowers volatility, which reduces the impact of the return sequence. This is key to ensuring your portfolio lasts throughout your retirement.

This last point is particularly important for expats in emerging markets. As shown in the study, emerging markets are one of the most volatile asset classes. As such, they are most affected by return sequence and have the most impact on how long your portfolio will last. If you are a retiree in an emerging market, the equity of that emerging market should play only a very small role in your portfolio.

Minimizing the Luck Factor

No one knows what the markets will do during retirement. This is the luck factor. To minimize the impact of luck (or the return sequence you encounter) on your retirement planning:

- Diversify your portfolio. This is key to lowering portfolio volatility and reducing the impact of sequence risk on how long your portfolio lasts.

- Stress-test your retirement plan. It's not enough to assume you will receive the average return each and every year through your retirement. Test your plan against actual returns during different historic and economic periods. Look at return sequences where the poor returns occur upfront. Use Monte Carlo testing to generate thousands of potential return sequences and see how your plan stands up.

If you are a retiree in an emerging market, remember that emerging market equity and currency add another layer of volatility to expat portfolios. Plan accordingly.

This article is a revised and updated version of one that had appeared previously on www.crevelingandcreveling.com.

Additional Resources

- Expat Financial Planning: Will Your Portfolio Last Through Retirement?

- Expat Investing: Are Unrealistic Expectations Derailing Your Investment Plan?

- Five Obstacles to Effective Expat Retirement Planning

About Creveling & Creveling Private Wealth Advisory

Creveling & Creveling is a private wealth advisory firm specializing in helping expatriates living in Thailand and throughout Southeast Asia build and preserve their wealth. The firm is a Registered Investment Adviser with the U.S. SEC and is licensed and regulated by the Thai SEC. Through a unique, integrated consulting approach, Creveling & Creveling is dedicated to helping clients cut through the financial intricacies of expat life, make better decisions with their money, and take the steps necessary to provide a more secure future.

Copyright © 2023 Creveling & Creveling Private Wealth Advisory, All rights reserved. The articles and writings are not recommendations or solicitations, and guest articles express the opinion of the author; which may or may not reflect the views of Creveling & Creveling.