Five Obstacles to Effective Expat Retirement Planning

By Chad Creveling, CFA, and Peggy Creveling, CFA

It's not news that we're facing a retirement crisis. According to a recent U.S. study conducted by PWC: “There are too many signs suggesting the population is unprepared. A quarter of US adults have no retirement savings and only 36% feel their retirement planning is on track. Even for those who are saving, many will likely come up short.” PWC found that those immediately approaching retirement (55- to 64-year-olds) only had about U.S. $120,000 saved for retirement.

A number of structural issues—a shift away from corporate pensions, spiraling health care and education costs, lack of job stability, greater longevity, and the demise of the nuclear family—have all contributed to the coming crisis.

A lack of planning also plays a big role. According to the most recent EBRI Retirement Confidence Survey, just under half of those surveyed (48 percent) reported that they and/or their spouse had ever tried to calculate how much money they would need to have saved so that they could live comfortably in retirement.

For those seeking to retire in emerging and developing markets, planning is even more important as retirees may have to deal with rapid changes in the costs of certain items such as housing or health care, increased currency volatility, and the absence of the social safety nets available in home countries.

Unfortunately, a number of issues related to inertia, misguided assumptions, and a lack of focused planning can result in expats who are inadequately prepared for retirement. Here are some of the biggest obstacles to coming up with an effective retirement plan.

Key Impediments to Effective Retirement Planning

-

Not knowing how much is needed for retirement: Most workers underestimate the amount of savings required to fund a comfortable retirement. They would be surprised to know that the often-quoted “rule of thumb” 4% withdrawal rate means that it takes about $250,000 invested in a well-diversified portfolio to safely provide $10,000 in inflation-adjusted income each year over a 30-year retirement.

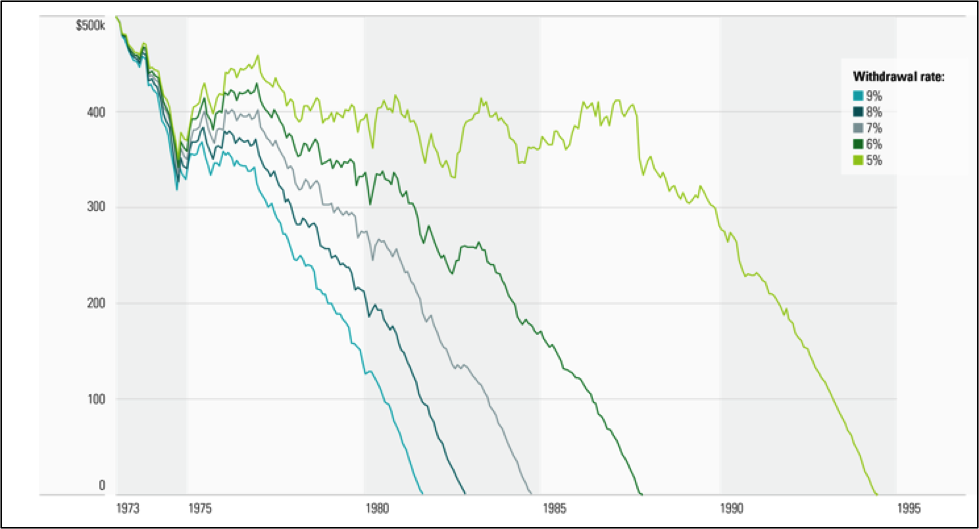

The Morningstar chart below shows a hypothetical 50% equity/50% fixed-income portfolio and the effect various inflation-adjusted withdrawal rates have on the end value of a portfolio experiencing actual market returns over a long payout period. The hypothetical portfolio had an initial starting value of $500,000. The investor retired on Dec. 31, 1972, and withdrew an inflation-adjusted percentage of the initial portfolio wealth ($500,000) each year beginning in 1973. As illustrated, the higher the withdrawal rate, the greater the chance of potential shortfall. The lower the rate, the less likely you are to outlive your portfolio.

Potential Shortfall: The Risk of High Withdrawal Rates

Annual Inflation-Adjusted Withdrawal as a % of Initial Portfolio Wealth

Source: Morningstar, Inc.

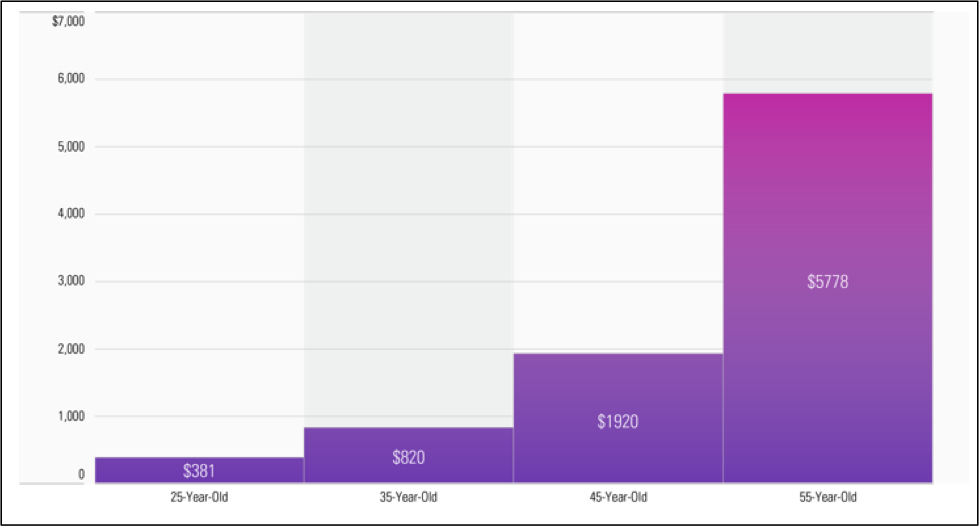

- Not knowing how much to save: Closely linked to knowing how much is needed to fund a comfortable retirement is knowing how much to save each year to get there. Just the act of saving in itself is not sufficient (and only 52% of workers are doing that). Most are not saving nearly enough to reach their retirement goals. It's critical to calculate how much you'll need to save each year to reach your retirement goals. One thing is for sure: The earlier you start, the easier it is.

The Earlier You Start Investing, the Easier It Is to Reach Your Goals

Monthly Savings Needed to Accumulate $1 Million by Age 65

Source: Morningstar, Inc.

- Assuming expenses will go down in retirement: Conventional wisdom has it that expenses in retirement will go down. Recent studies, however, show this may not be the case. Better health, active lifestyles, spiraling health care costs, caring for elderly parents, supporting children, etc., all can result in higher-than-expected spending in retirement. A good rule of thumb is to take what you're currently spending as your baseline retirement spending. Of course, this number is highly individualistic, and you should carefully work through your expenses to determine your actual spending in retirement.

For those who plan to retire to "cheaper" emerging markets, you need to consider that these countries tend to have higher inflation rates for the basket of goods expats tend to consume and substantially higher currency volatility, which can quickly erode the "cheapness" factor.

- Unrealistic expectations for investment returns: Many people have unrealistic expectations of what they can earn on their investments over the long run. Some expect they should be able to earn double-digit returns year in and year out on their portfolios. This is far from reality. You may earn a double-digit return in some years, but over the long run, most properly constructed investment portfolios will earn a real rate of return (minus inflation) of just 3–5%. When calculating the annual savings required to reach your retirement goals, it's important to use realistic rates of return or you risk coming up short.

- Assuming the ability to work in retirement: According to an Associated Press-NORC poll, among American adults age 50 and older, 56% say they will work past the traditional retirement age of 65 or are already doing so, with nearly 6 in 10 (59%) saying that financial concerns (59 percent) are a major reason why they have chosen to work past the traditional retirement age.

But workers past normal retirement age may have little control over when they stop working. In the AP-NORC poll, 66% of retired Americans say they retired by choice, while 34% say they had no choice but to retire, with the most common reason being a health problem or disability. Health issues, disability, downsizing, and need to care for a family member cause many to leave the workforce earlier than desired. For those still able to work, salaries are likely to be less than they were during peak earning years.

A Little Planning Goes a Long Way

Saving for retirement can seem daunting, but a little planning can go a long way to ensuring a comfortable retirement. Starting with some concrete goals and working from realistic assumptions will help produce an effective plan.

Plenty of research shows that those who establish formal plans engage in behaviors that help them achieve their goals. According to a Deloitte survey, those with a formal plan felt four times more secure about their financial future than those without one. Whether you work with a financial planner or do it yourself, the trick is to get started.

This article is a revised and updated version of ones that have appeared previously on www.crevelingandcreveling.com.

Additional Resources

Top Expat Portfolio Mistakes and How to Avoid Them

Choosing an Expat Investment Strategy: Your Time Horizon Matters

Expat Investment Advice: Five Tips to Generate Income from Your Portfolio in Retirement

About Creveling & Creveling Private Wealth Advisory

Creveling & Creveling is a private wealth advisory firm specializing in helping expatriates living in Thailand and throughout Southeast Asia build and preserve their wealth. The firm is a Registered Investment Adviser with the U.S. SEC and is licensed and regulated by the Thai SEC. Through a unique, integrated consulting approach, Creveling & Creveling is dedicated to helping clients cut through the financial intricacies of expat life, make better decisions with their money, and take the steps necessary to provide a more secure future.

Copyright © 2021 Creveling & Creveling Private Wealth Advisory, All rights reserved. The articles and writings are not recommendations or solicitations, and guest articles express the opinion of the author; which may or may not reflect the views of Creveling & Creveling.