Expat Financial Planning: Will Your Portfolio Last Through Retirement?

By Chad Creveling, CFA & Peggy Creveling, CFA

Once you stop earning a salary, the focus quickly turns to how you will generate an income to fund your retirement. If you're lucky, you have one of those rare corporate or government pensions. Most of us, however, are going to have to rely on social security or national pensions and whatever investment savings we have to fund retirement. For many expats who have not paid into national pension schemes or may not be eligible, the investment portfolio will be the main source of retirement funding.

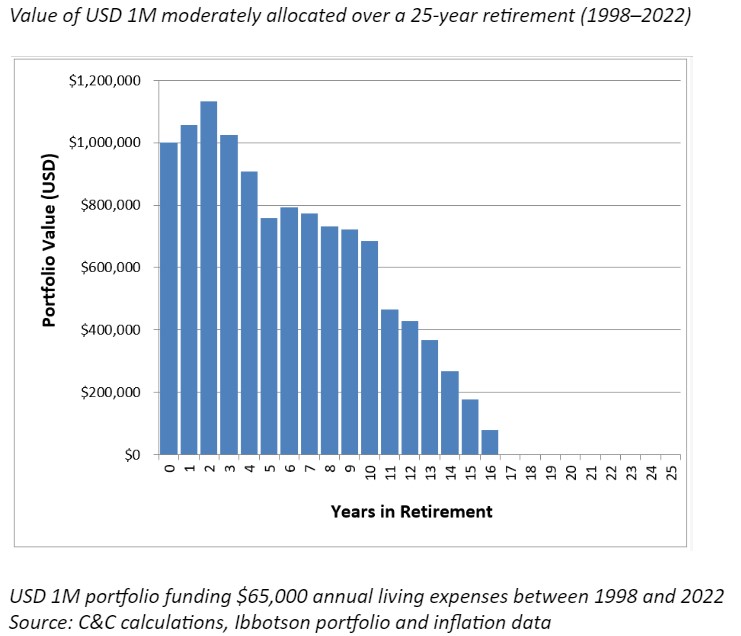

Unfortunately, many don't understand how to generate income from a retirement portfolio and are unaware of some key concepts such as sequence risk and the connection between sustainable withdrawal rates, portfolio structure, and retirement time horizon. Far too many rely on quarterly or annual returns and a focus on short-term market volatility to evaluate and make decisions about their retirement portfolios. Unfortunately, that can lead to disaster, as in the following case where the retiree, expecting his retirement funds to last 25 years, would run out of money after 16 years in retirement:

Running Out of Money

What Matters for Making Your Portfolio Last

One key factor that matters is the withdrawal rate. The withdrawal rate is the percentage of the initial portfolio that is adjusted for inflation and withdrawn from the portfolio each year regardless of portfolio performance.

In the example in the graph above, a portfolio of $1 million with an annual withdrawal of $65,000 would represent an initial withdrawal rate of 6.5% in the first year of retirement. In the next year, the retiree increased the $65,000 withdrawal by the rate of inflation, and continued inflation adjustments each year until the end of the retirement plan or his money ran out. Since you cannot predict the sequence of annual returns for your retirement period, it is important to determine how much you can safely pull from your portfolio on an inflation-adjusted basis each year without running out of money.

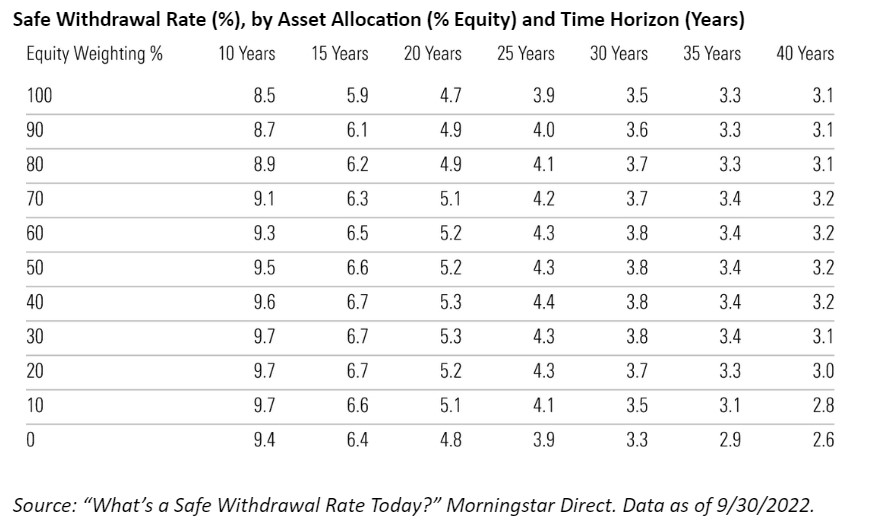

Settling on a safe initial withdrawal rate is important. Morningstar, a leading provider of financial information, looked at safe withdrawal rates as they related to different portfolio asset allocations and portfolio longevity.

Morningstar defined a safe withdrawal rate to be one that would secure a retiree a 90% probability of not running out of money, and then varied asset allocation (Equity Weighting, %) against Time Horizon (number of years the portfolio would last), and concluded the combinations in the following table could work.

You Can't Avoid Risk

There are several observations from the table above:

- For a 25-year time horizon, an approximate 4.3-4.4% withdrawal rate could be considered “safe” (not running out of money) over a few asset allocations. This assumes that the retiree diligently adhered to the withdrawal rate and the targeted allocation over all 25 years and through all market conditions. Not doing so would have decreased the success rate significantly.

- 4.3% is not a big number. This means that you could only pull an inflation-adjusted $43,000 from a $1 million portfolio (before paying taxes) to have a reasonable level of confidence that you would not run out of money.

- For periods longer than 25 years, a safe withdrawal rate would be lower. Having a realistic idea of a reasonable time horizon is clearly important. Thirty percent (30%) of healthy nonsmoking 65-year-olds may live longer than 25 years, or 90 years old. And someone beginning retirement withdrawals at age 55 would have a reasonable chance of living 35+ years in retirement and should plan accordingly.

- For the longest time horizons, safe withdrawal rates were not much more than 3%. Relatively short time horizons allowed for higher withdrawal rates. Withdrawal rates above 6% were only safe for shorter time horizons such as 10-15 years.

- Adding some equity to a fixed income allocation increased the success rates (up to a point). This is because the higher growth that can equity provide over the longer run allows for the greater withdrawal rates.

What's Your Sustainable Withdrawal Rate?

Generating an income stream from a retirement portfolio is a delicate balance of sustainable withdrawal rates, time horizon, and asset allocation. Unfortunately, far too few retirees understand this and instead either don't manage their spending or portfolios effectively or focus on short-term performance metrics such as quarterly or annual portfolio returns, which have little bearing on portfolio longevity.

The table above assumes a retiree is diligently calculating a withdrawal rate each year and is following a targeted portfolio strategy through all the market ups and downs without abandoning their strategy over their retirement period. Withdrawing too much, too often, or getting spooked out of following a longer-term portfolio strategy by focusing too much on short-term volatility can significantly increase the chance of depleting the portfolio before the end of the retirement period.

Additionally, as Morningstar notes in their research, many retirees do not spend a fixed amount each year. Typically, retirement spending is higher in early years due to travel and other discretionary spending, may decrease for a period as discretionary spending slows, and then rise again to cover higher healthcare costs in later years. It is therefore important to re-evaluate retirement planning from time to time to ensure you are on track.

This article is a revised and updated version of an article that originally appeared on www.crevelingandcreveling.com.

Additional Resources

- Expat Financial Planning: Overcome Mental Roadblocks and Get Started Saving

- Expat Investing: In Retirement, the Sequence of Returns Matters

- 5 Steps to Help Expatriates Save More for Retirement

About Creveling & Creveling Private Wealth Advisory

Creveling & Creveling is a private wealth advisory firm specializing in helping expatriates living in Thailand and throughout Southeast Asia build and preserve their wealth. The firm is a Registered Investment Adviser with the U.S. SEC and is licensed and regulated by the Thai SEC. Through a unique, integrated consulting approach, Creveling & Creveling is dedicated to helping clients cut through the financial intricacies of expat life, make better decisions with their money, and take the steps necessary to provide a more secure future.

Copyright © 2023 Creveling & Creveling Private Wealth Advisory, All rights reserved. The articles and writings are not recommendations or solicitations, and guest articles express the opinion of the author; which may or may not reflect the views of Creveling & Creveling.