Choosing an Expat Investment Strategy: Your Time Horizon Matters

As an expat investor, how much of your portfolio should you allocate to less risky or less volatile investments (such as bonds) versus riskier or more volatile equity investments (such as stocks)? It's a fundamental consideration, but the best allocation is not always obvious. Complicating the decision, market noise tends to focus on the most recent best-performing investments, creating a “fear of missing out” (FOMO) response in inexperienced investors. Rather than choosing and sticking to an appropriate allocation, many get caught up in a greed-fear cycle—forever buying high and selling low—the exact opposite of what they were trying to achieve.

Consider Your Time Horizon

For expat investors, your investment portfolio’s time horizon is one of the most important factors to consider in selecting an asset allocation (mix of stocks/fixed income/cash). Your portfolio’s time horizon is how long you have until you plan to spend your investment. A time horizon could range from the very near term (virtually immediately) to the very long term (spent over the rest of your life—for example, in retirement). The reasons why time horizon is important to your asset allocation decision are outlined below.

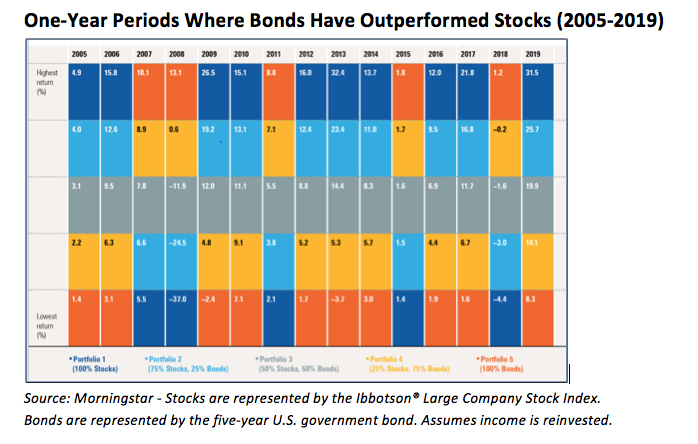

Bonds Can Beat Stocks for Single Years

While investors tend to think stocks will always outperform fixed income and cash, the fact is bonds can and do outperform stocks during certain time frames. For example, over the past 15 years, an all-bond portfolio has been the best annual performer five times. That’s one-third of the time:

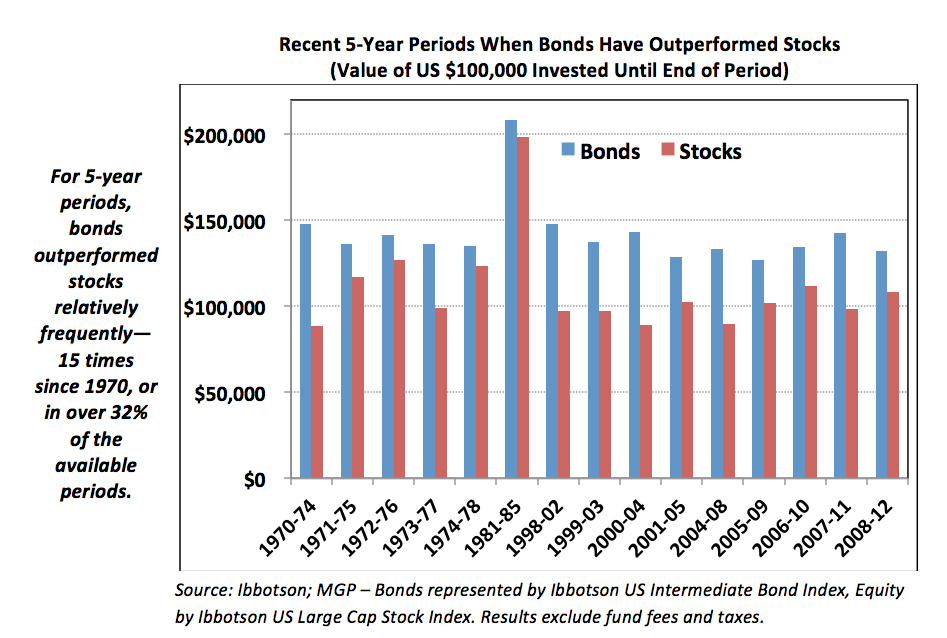

Bonds Can Also Beat Stocks for Multi-Year Periods

Bond outperformance is not limited to just single-year periods that include sharp stock market corrections. Bonds have outperformed stocks over longer periods. For example, since 1970, U.S. bonds have outperformed U.S. stocks in 15 five-year periods (from January 1 through December 31), or in 32% of the available periods:

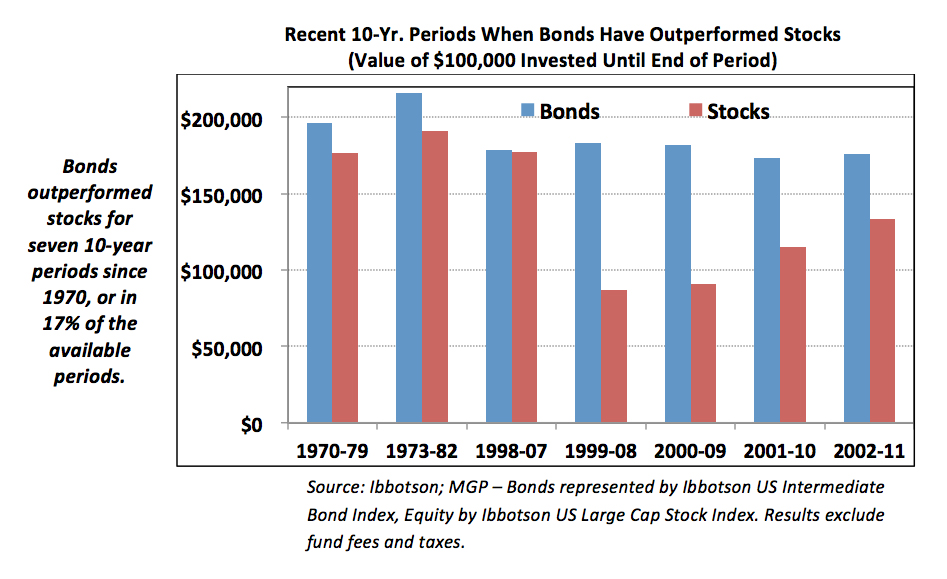

There have also been times when bonds have outperformed stocks over even longer periods, stretching to 10 years. This occurs more frequently than most investors realize. Since 1970, in U.S. markets, there have been seven 10-year periods (beginning January 1) where bonds (as measured by Ibbotson U.S. Intermediate-Term Government Bonds) have outperformed stocks (as measured by Ibbotson U.S. Large Cap Stocks).

For Shorter-Term Time Horizons, Hold a Greater Percentage of Bonds or Cash

As the above graphs show, it is not that rare for bonds to outperform stocks over shorter time frames, and even ranging for periods such as five and even 10 years. As bonds have less short-term volatility than stocks, the periods where stocks underperform are almost always due to stocks falling in price substantially during the investment period. Unfortunately, predicting when these periods will occur in advance is not an exact science.

Therefore, the key to successfully selecting what percentage of stocks or bonds to hold therefore lies in your time horizon, or when you will need the funds. For shorter-term goals (10 years or less) such as college education for kids or investing to put a deposit down on a house, expat investors may not be able to risk the chance of a steep short-term decline in value that is possible when investing in stocks. And for funds that may need to be accessed immediately (such as an emergency fund), the best choice may be very-low-risk (in terms of volatility) investments, such as cash denominated in the currency it will be needed in.

This article is a revised and updated version of one that had appeared previously on www.crevelingandcreveling.com.

Additional Resources:

The Top 5 Investment Mistakes Expats Make (and How to Avoid Them)

Seven Things Expats Need to Know About Investing

Expat Case Study: Overcoming the Cycle of Greed and Fear in Investing

About Creveling & Creveling Private Wealth Advisory

Creveling & Creveling is a private wealth advisory firm specializing in helping expatriates living in Thailand and throughout Southeast Asia build and preserve their wealth. The firm is a Registered Investment Adviser with the U.S. SEC and is licensed and regulated by the Thai SEC. Through a unique, integrated consulting approach, Creveling & Creveling is dedicated to helping clients cut through the financial intricacies of expat life, make better decisions with their money, and take the steps necessary to provide a more secure future.

Copyright © 2020 Creveling & Creveling Private Wealth Advisory, All rights reserved. The articles and writings are not recommendations or solicitations, and guest articles express the opinion of the author; which may or may not reflect the views of Creveling & Creveling.