WSJ Ask an Expert: An ITIN Primer: Everything You Need to Know About U.S. Individual Tax Identification Numbers

The Wall Street Journal invited Creveling & Creveling to be part of a panel of experts for personal finance on its WSJ Expat site. The following article originally appeared on the WSJ site and has been shared with permission.

We asked Peggy and Chad Creveling of Asia-based Creveling & Creveling Private Wealth Advisory for the ultimate ITIN (U.S. Individual Tax Identification Number) primer for Nonresident Aliens (NRAs) or American expats with NRA spouses: What is an ITIN and why might someone need one? Is having one beneficial or does it mean you have to pay U.S. tax on your global income? These are questions often asked by people who are considered to be nonresident aliens for U.S. income tax purposes or by their U.S. expat spouses. Here are some answers to commonly asked questions about ITINs:

What is an Individual Tax Identification Number (ITIN)? The IRS issues ITINs to people such as nonresident aliens (NRAs) who don't qualify for a Social Security Number (SSN) but need an SSN-like number. For example, ITINs may be required for filing U.S. taxes, to claim or allow a spouse to claim a tax benefit, or in case of tax withholding on some types of U.S.-source income such as pensions or gambling winnings.

Here are some categories of people who may need an ITIN:

- A nonresident alien required to file a U.S. tax return

- A U.S. resident alien (based on days present in the U.S.) filing a U.S. tax return

- A dependent spouse of a U.S. citizen or resident alien

- A dependent or spouse of a nonresident alien visa holder

Why does the IRS require ITINs? Each ITIN is unique, unlike names, and they're used in the U.S. federal tax system as individual identifiers to avoid confusion and duplication. ITINs don't have other purposes. For example, simply having an ITIN doesn't allow U.S. employment or provide Social Security benefits, nor does it mean someone is automatically subject to paying U.S. tax.

I'm an expat U.S. citizen and my spouse is a nonresident alien for U.S. income tax purposes. Does my spouse need an ITIN? Not necessarily. If you wish to make a special election to file married filing jointly (MFJ) under I.R.C. 6013 (g), then yes, your spouse will need to apply for an ITIN. Additionally, if you plan to file either married filing separately (MFS) or head of household (HoH) and claim a personal exemption for your NRA spouse, then your spouse will also need to apply for an ITIN.

However, your spouse won't need an ITIN simply because you file MFS or HoH as long as you're not claiming a spousal exemption. According to IRS Publication 17, page 22, in the case of MFS you can simply write in "NRA" instead of an ITIN. (Note: this option may not be available if you efile and that you cannot choose to file "Single" if you are married.)

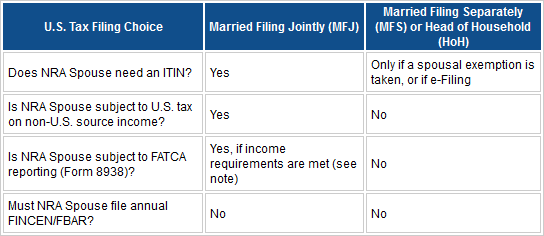

Does having an ITIN mean I'm subject to the Foreign Account Tax Compliance Act (Fatca) or require that I file an annual Report of Foreign Bank and Financial Accounts (Fbar)? Merely having an ITIN doesn't subject you to Fatca reporting rules (for 1040 filing) or Fbar filing (FinCEN Form 114 U.S. Treasury report filed online by June 30 each year). However, if you are a U.S. Resident Alien for income tax purposes (physically living in the U.S.), then you're subject to both Fatca and Fbar reporting and filing rules. If you've chosen to be considered a U.S. Resident Alien under the MFJ special election, you're subject to Fatca reporting rules as part of your annual 1040 filing. However, the rules are different for annual filing of the Fbar for NRAs who are only considered to be Resident Alien due to their spouse making an MFJ election. The BSA Compliance Department has confirmed by email ( FBARQuestions@irs.gov) that being considered a Resident Alien under the MFJ special election doesn't make you a U.S. resident for Fbar filing purposes. See the table below for more details.

If my NRA spouse gets an ITIN, do they have to pay U.S. tax on their global income? Merely having an ITIN does not make someone subject to U.S. tax. If your spouse has U.S.-sourced income, then they'll need to pay U.S. tax on their U.S. income whether or not they already have an ITIN. If you choose the special election to file MFJ, then yes, your NRA spouse's global income is subject to U.S. reporting and tax. But if you file either MFS or HoH and your spouse has no U.S. income, then no, your spouse's non-U.S.-source income is not subject to U.S. tax — even if they have an ITIN and you claim a spousal exemption for them.

U.S. Expatriates with NRA Spouses – Filing Choice Summary

Note: Filing "Single" is not allowed if you are married. To check spousal income requirements for Fatca reporting, check here.

Do ITINs ever expire? Yes. According to an updated IRS policy on ITINs, they "will expire if not used on a federal income tax return for any year during a period of five consecutive years."

How do I get an ITIN? To apply for an ITIN, use the latest version of Form W-7, Application for IRS Individual Taxpayer Identification Number and follow the Form W-7 Instructions.

Additional Resources:

General ITIN Information

Frequently Asked Questions (FAQs) About International Individual Tax Matters