RSUs vs. NQSOs: Financial Planning Tips for Expat Executives at Multinationals

Expatriate executives working for multinational corporations frequently receive part of their compensation in the form of long-term incentive (LTI) awards linked to their employer’s stock. Often, the expat executive has a choice of receiving restricted stock units (RSUs), nonqualified stock options (NQSOs), or a combination of the two.

If you’re an expat executive being offered RSUs or NQSOs, you’ll want to think carefully before making your choice. Your decision to receive your LTI award as either RSUs or NQSOs basically involves selecting between a sure thing and a gamble. The RSUs will always have value (except if your company goes bankrupt), while the NQSOs are a leveraged bet on the share price performance over the option grant period. You’ll want to understand when the odds are stacked in your favor and when they aren’t. To help you with the choice, below are some tips on how to choose between RSUs and NQSOs.

NINE TIPS FOR LONG-TERM INCENTIVE AWARDS

- LTI equity awards aren’t “freebies”—they’re a significant part of your overall compensation. LTI awards are deferred compensation, yet there’s a tendency for expats to view them as more of a nice extra. The reality is that your employer intends these grants to be part of your overall paycheck, right along with your cash salary and annual bonus. You probably wouldn’t take 25% of your salary or bonus to buy options on your company’s stock, or at least not without careful consideration. It’s therefore worth it to spend a little time understanding these awards so you can make an informed decision and maximize your long-term financial health.

- What are RSUs? RSUs are your employer’s pledge to issue you a specific number of shares at a future time when they vest or become unrestricted. Generally, RSUs vest or become unrestricted a specific number of years following their grant date, or sometimes in stages over several years. At that point, the RSUs are converted into company shares, less any taxes due at your marginal tax rate.

If you’re part of a tax equalization program, a hypothetical tax may be deducted from the shares you receive, with your company separately paying the actual tax due on your behalf. After this, the shares that are left are then yours to keep or sell. Any future tax you may owe will be the actual tax due (capital gains and dividends) according to your tax residency. If your company is listed in the U.S., a withholding tax on dividends may be deducted at source.

- What are NQSOs? NQSOs give you the right to purchase a specific number of your company’s shares at a set price at some point in the future. NQSO grants typically have a grant date, an exercise price (usually the company’s price at the time of grant), a vesting schedule, and an expiration date. Once the NQSOs vest, you can exercise them by purchasing shares at the exercise price. Typically, you’ll be able to purchase the shares in a “cashless transaction,” meaning a portion of the shares will be deducted for the exercise price as well as a portion for any tax that may be due.

Unlike with RSUs, tax is not deducted when the NQSOs vest, but only when you actually exercise the options. If you’re part of a tax equalization program, a hypothetical tax may be deducted from the shares you receive once you exercise, with your company separately paying the actual tax due on your behalf. After this, the shares that are left are yours to keep or sell. Any future tax you may owe will be the actual tax due (capital gains and dividends) according to your tax residency. If your company is listed in the U.S., a withholding tax on dividends may be deducted at source.

- How many RSUs or NQSOs? If you were to receive an LTI award of $100,000, your U.S. multinational employer’s stock price at the time of grant is $20, and the translation ratio between RSUs and NQSOs is 1:4, you may have a choice of initially receiving either 5,000 RSUs (100,000/20) or 20,000 NQSOs (100,000/20 x 4). If you choose RSUs, once they vest, you’ll receive 5,000 shares, less shares for the taxes deducted (hypothetical taxes if there’s a tax equalization program). If you choose NQSOs, once they vest and you exercise them, you’ll receive 20,000 shares, less shares to cover the exercise price (in this case, $400,000) and for the taxes deducted (hypothetical taxes if there’s a tax equalization program).

- RSUs retain some value, but NQSOs can expire worthless. An important difference between RSUs and NQSOs is that unless your company goes bankrupt, the RSUs will always retain some value. NQSOs start out with no value and gain value only if your company’s share price appreciates. If the share price stays below its exercise price until the NQSOs expire, the options expire worthless. Although that may seem unlikely, it can happen, especially if the NQSOs were granted when the company share price was at a relative high. Therefore, RSUs offer less risk compared with NQSOs—a sure thing versus a gamble.

- Your time horizon matters. If you must choose between RSUs and NQSOs, how long you plan to continue working for the company and when you plan to spend the funds from the award both matter. For shorter time frames, RSUs may be the better choice as they have an initial value and are likely to retain it. However, if you plan to stay employed until the NQSOs expire (often after 10 years), your company’s share price could appreciate. As such, the value of NQSOs could eclipse the value of RSUs and their converted stock, if you can wait to exercise them until later years.

Breakeven Time Frame, RSUs vs. NQSOs

Breakeven Time Frame, RSUs vs. NQSOs

The graph represents a $100,000 LTI award taken either 100% in RSUs or 100% in NQSOs, using a grant price of $20 and U.K. tax equalized at a marginal rate of 45%. In both cases, the award is completely vested after three years. Assume the underlying share price appreciates on average of 5.5% per year and pays a dividend yield of 2.5%. After vesting, the after-tax value of the RSUs converted to stock are likely to be worth more initially, but the NQSOs may be worth more after tax if they are exercised in later years.

As illustrated in the above graph, to have a chance of receiving more value from NQSOs than RSUs, you’d want to be able to wait to exercise your NQSOs. If you don’t think you’ll remain with your current company longer than a few years, or if you know you’ll need to spend the cash raised from the grant soon after vesting, choosing RSUs may make more sense.

- How well your company stock performs also matters. It is important to consider how well you expect your company’s share price to do in the years after the grant. As previously discussed, NQSOs have value only when the share price increases above the exercise price.

If you know you’ll be staying with your company for a certain number of years, another way to look at breakeven is to determine the average growth rate per year the company share price must achieve in order for the RSUs and NQSOs to have the same value. If we use the same assumptions from the example above, we can estimate a 10-year breakeven growth rate averaging 3.55%.

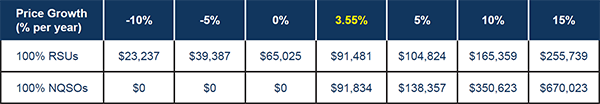

RSUs vs. NQSOs: Value of $100,000 LTI Equity Award After 10 Years, at Various Growth Rates

Note: Assumes U.K. tax equalization 45% marginal rate, dividend yield of 2.5%, withholding tax on dividends of 15%.

If company shares appreciate more than 3.55% per year on average over 10 years, then the NQSOs could be the better choice. Alternatively, a lower price appreciation or fall in share price during that time would make the RSUs a better choice.

- Have an exit strategy for NQSOs—don’t wait too long to exercise. If you choose NQSOs, make sure you don’t wait until the last minute to exercise them. Share prices are volatile and unpredictable, especially over short periods. It’s entirely possible for your company’s share price to nosedive just before you intend to exercise your options, making them expire worthless. To avoid this, you’ll want to have an exit strategy if you choose NQSOs. There are many ways to devise such a strategy, some more complex than others. Here’s one relatively simple strategy: If your NQSOs are within two years of expiration (or you are two years away from leaving your company), start to exercise the NQSOs on a quarterly basis.

- Consider splitting the award (if allowed). Often, you can choose to take a portion of your LTI award in RSUs and a portion in NQSOs. This could make sense under many scenarios. Say you’re planning to stay at your company for 10 years, but you want to purchase a house within the next five years. In this case, you might choose a portion of the award in RSUs to make sure that you’ll have adequate funds for the deposit within that time frame. Depending on when you might need the remaining amount, how long you plan to stay at your company, or how you expect your company’s stock to perform, you might wish to take the remaining amount in NQSOs.

MAKING THE CHOICE

For expatriate executives, a significant portion of your compensation may be paid to you in the form of LTI equity awards, including a choice between restricted stock units or nonqualified stock options. To get the most from your paycheck, you’ll want to make a selection that best suits your situation and does the most to put the odds in your favor. Be sure to consider how long you’ll continue to work for the company, when you plan to spend the funds from the award, and what you expect the share price to do. Using these items, the vesting schedules for the award, and various tax rates that apply to your specific situation, you can run some calculations to help determine which choice makes sense for you.