Expat Investment Advice: Tips to Deal with Market Volatility

By Peggy Creveling, CFA and Chad Creveling, CFA

The U.S. S&P 500 reaches a fresh high; European interest rates fall to new lows. The talking heads on cable financial networks argue about asset price bubbles and the likelihood of a market correction. For expatriates trying to manage their long-term portfolios, the current environment may be unsettling. But when it comes to successful long-term investing, having a plan to deal with short-term uncertainty and market volatility is extremely important. When the going gets tough and volatility picks up, here are some tips to keep from panicking and to help you stick with your long-term investment strategy:

- Set aside cash for short-term goals. Strip out or exclude cash required for short-term needs (the next five years) from your long-term portfolio. At a minimum, set aside funds as an emergency cash reserve. Depending on your specific situation, your cash reserves should cover at least several months of living expenses or possibly more. You may also have other specific short-term goals, such as a deposit for a property purchase, education for your kids, or moving expenses. Keep funds earmarked for each of these goals invested in cash or short-term fixed-income investments in the appropriate currency and separate from your long-term portfolio.

- Ignore short-term market noise. In the short term, market price levels move in cycles, fluctuating with the collective greed and fear of market participants. While there is no question that a contraction or a decline in overall price levels will occur at some point, when exactly one will occur is not known in advance. The financial gurus who are paid to make market predictions have no more insight than anyone else—in the short term, it's almost always something unforeseen that will determine what happens. When a correction does occur, it will not last. You don't want to risk forgoing the opportunity of achieving a long-term real return on your funds while waiting around for a possible short-term correction. "Using [short-term] volatility as a measure of risk is nuts. Risk to us is 1) the risk of permanent loss of capital, or 2) the risk of inadequate [long-term] return."—Charlie Munger, Vice Chairman, Berkshire Hathaway

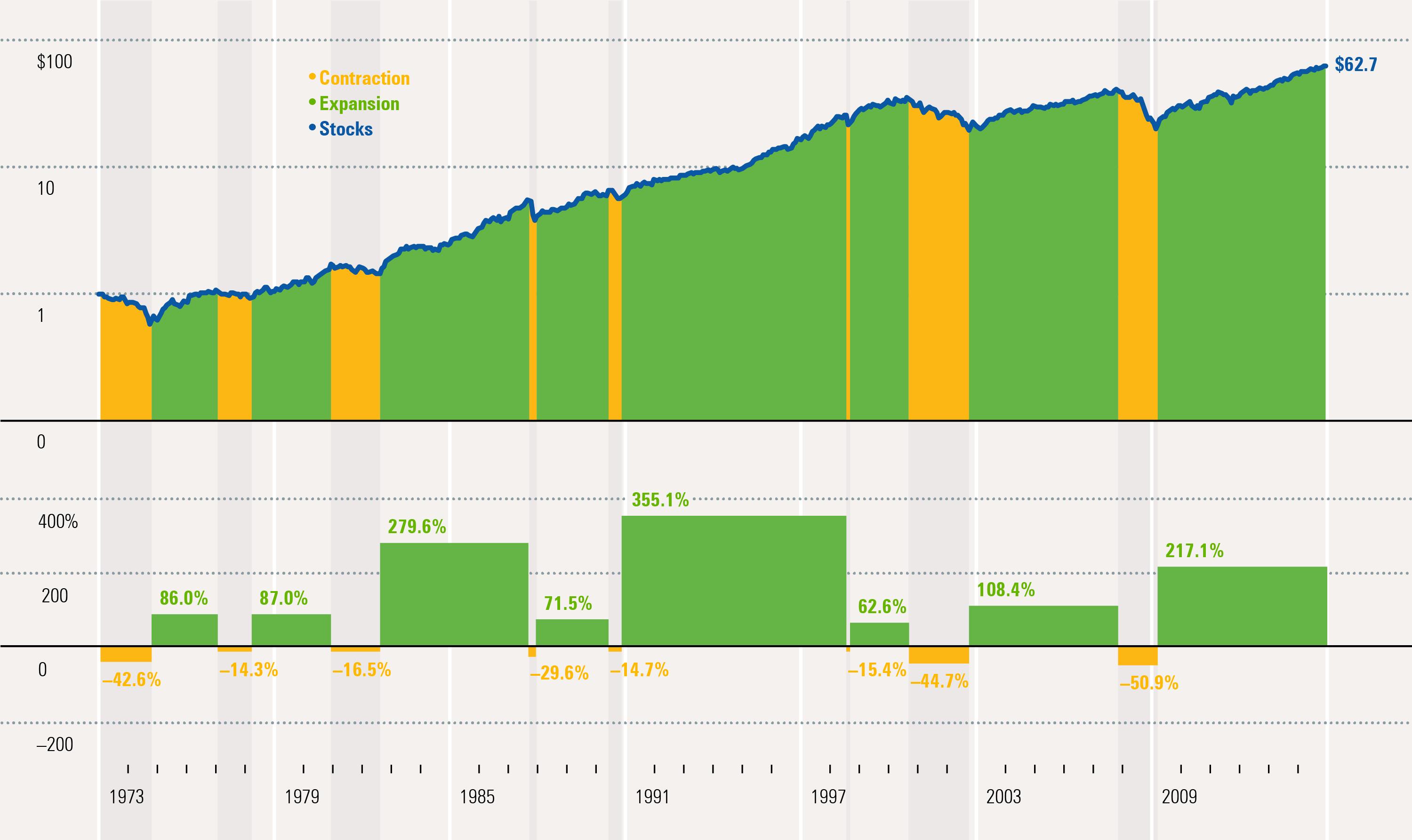

- Focus instead on the long term. Successful investing requires focusing on the long term. Remember that your long-term portfolio contains funds you'll use over the rest of your life. Long-term market movements are driven by fundamentals such as growth in the economy or the cash flows of listed companies. Over the long term the trend of markets has been up—for example, despite short-term contractions, USD 1 invested in U.S. large-cap stocks in 1973 would be worth USD 62.7 by the end of 2014, representing an average return of 10.6% per year.

U.S. Stock Market Contractions and Expansions (1973–2014)

Source: Morningstar, Inc. Large stocks are represented by the Ibbotson® Large Company Stock Index. Dividends reinvested.

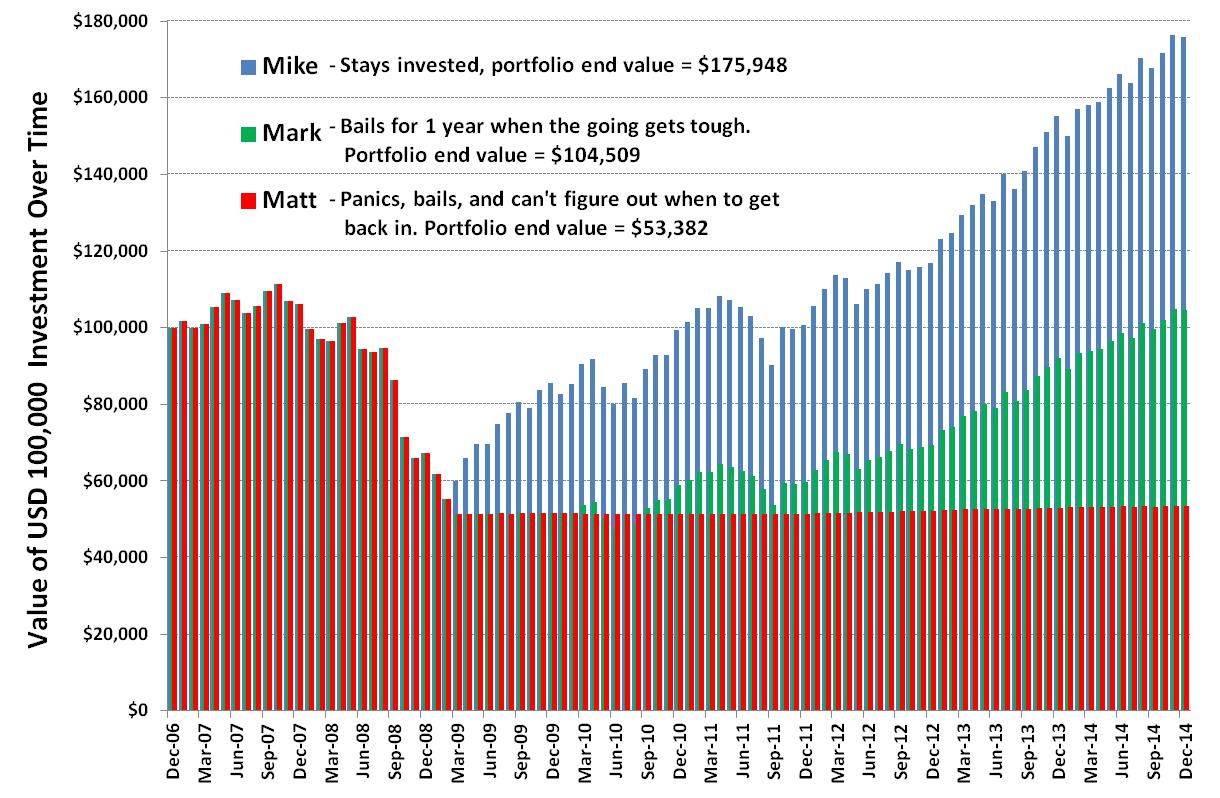

- Stick with a strategy. Evidence shows that it's far better to stay invested than to try to time a market correction and run the risk of missing a period of continued expansion. When you try to time the market, you'll find greed and fear working against you—many investors who cash out find they got out too soon or stayed out too long. Take the following example where three investors had USD 100,000 invested in an S&P 500 exchange-traded fund (ETF) during the period 2007–2014, which included the global financial crisis and the recovery that followed.

- The first investor, "Mike," stayed invested during the entire period. Although his portfolio value dropped to USD 51,372 at the worst point in early March 2009, he stayed in the market and reinvested all dividends that he received. By the end of 2014 his investment was worth USD 175,948.

- His friend "Mark" exited the market at the bottom (when the talking heads on cable financial networks said the S&P 500 would continue to fall) and invested in cash for a year. A year later, after learning how much better his friend Mike's portfolio was doing, he then re-entered the market and ended up with USD 104,509 at the end of 2014.

- The third friend, "Matt," cashed out after the fall, wasn't sure when to re-enter, and didn't think the subsequent rally was justified. He stayed out of the market and remained in cash, and ended up with only USD 53,582 by the end of 2014.

Which Investor Will You Be?

Source: C&C estimates of the value of $100,000 invested in Vanguard US Large-Cap ETF (VV), or a combination of VV plus Guggenheim Enhanced Ultra Short Dur ETF (GSY). Dividends reinvested.

The ups and downs that come with investing in a long-term portfolio that includes equity can be unsettling. However, it's important to remember that short-term uncertainty and market volatility come with the territory. Trying to hedge the volatility away or time the market will rarely work in your favor. Instead, strategies that do work include the following: Separate out cash you may need for the short term, remember that the long-term market trend is upward, and stick with your investment strategy. By following these basic principles, you'll end up ahead of the game.

Additional Resources

Expat Investing: Are Unrealistic Expectations Derailing Your Investment Plan?

Expat Investment Advice: Don't Chase Returns, Diversify Instead

Seven Things Expats Need to Know About Investing

Expat Case Study: Overcoming the Cycle of Greed and Fear in Investing