Expat Investment Advice: Tips for Dealing with Market Volatility

By Peggy Creveling, CFA and Chad Creveling, CFA

Volatility in global markets picks up sharply as investors’ worry grow and discontent spreads. Talking heads on financial news programs discuss uncertainty over inflation and economic forecasts while US treasury yields gyrate and crude oil and gold prices rise and fall. For expatriates trying to manage their long-term portfolios, there are times that financial news flow and market volatility can be particularly unsettling.

In this environment, what should expat investors do? Nothing is more detrimental to your long-term investment returns than getting caught up in a greed/fear cycle, which can cause investors to buy at relatively high prices and then sell low. This time is no different. When it comes to successful long-term investing, it is extremely important to have a plan to deal with short-term uncertainty and market volatility to avoid this trap.

When the going gets tough and volatility picks up, here are some tips to keep from panicking and help you stay on track and stick with your long-term investment strategy:

1. Set Aside Cash for Short-Term Goals

Strip out or exclude cash required for short-term needs (up to the next five years) from your long-term portfolio. At a minimum, set aside funds as an emergency cash reserve. Depending on your specific situation, your cash reserves should cover at least several months of living expenses or possibly more. You may also have other specific short-term goals, such as a deposit for a property purchase, education for your kids or yourself, or moving expenses. Keep funds earmarked for each of these goals invested in cash or short-term fixed-income investments in the appropriate currency and separate from your long-term portfolio.

2. Ignore Short-Term Market Noise

In the short-term, market price levels move in cycles, fluctuating with the collective greed and fear of market participants. While there is no question that a contraction or a decline in overall price levels occurs from time to time, when exactly one may start (or critically, end) is not known in advance. The financial gurus paid to make market predictions have no more insight than anyone else—in the short-term, it's something unforeseen that will determine what happens. When corrections do occur, they do not last forever. You don't want to bail on a long-term strategy intended to provide cash flow for the rest of your life. Reacting to short-term market conditions can risk forgoing the opportunity of achieving a real long-term return on your funds.

"Using [short-term] volatility as a measure of risk is nuts. Risk to us is 1) the risk of permanent loss of capital, or 2) the risk of inadequate [long-term] return."—Charlie Munger, Vice Chairman, Berkshire Hathaway

3. Focus Instead on the Long Term

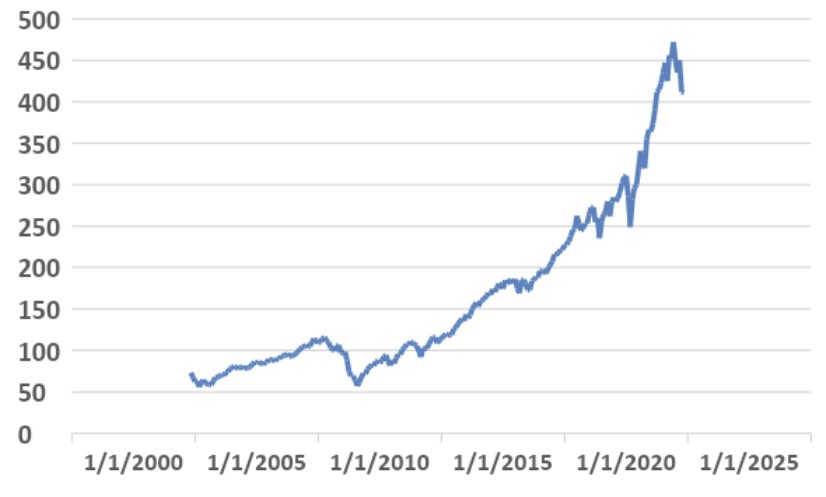

Successful investing requires focusing on the long term. Remember that your long-term portfolio contains funds you'll use over the rest of your life. Long-term market movements are driven by fundamentals such as growth in the economy or the cash flows of listed companies. Over the long term, the trend of markets has been up—for example, despite short-term contractions, USD 1 invested in U.S. large-cap stocks in May 2002 would be worth USD 5.63 twenty years later in May 2022, earning an annualized average return of 9.0% including dividends:

S&P 500 Contractions and Expansions (May 2002–May 2022)

4. Stick With a Strategy

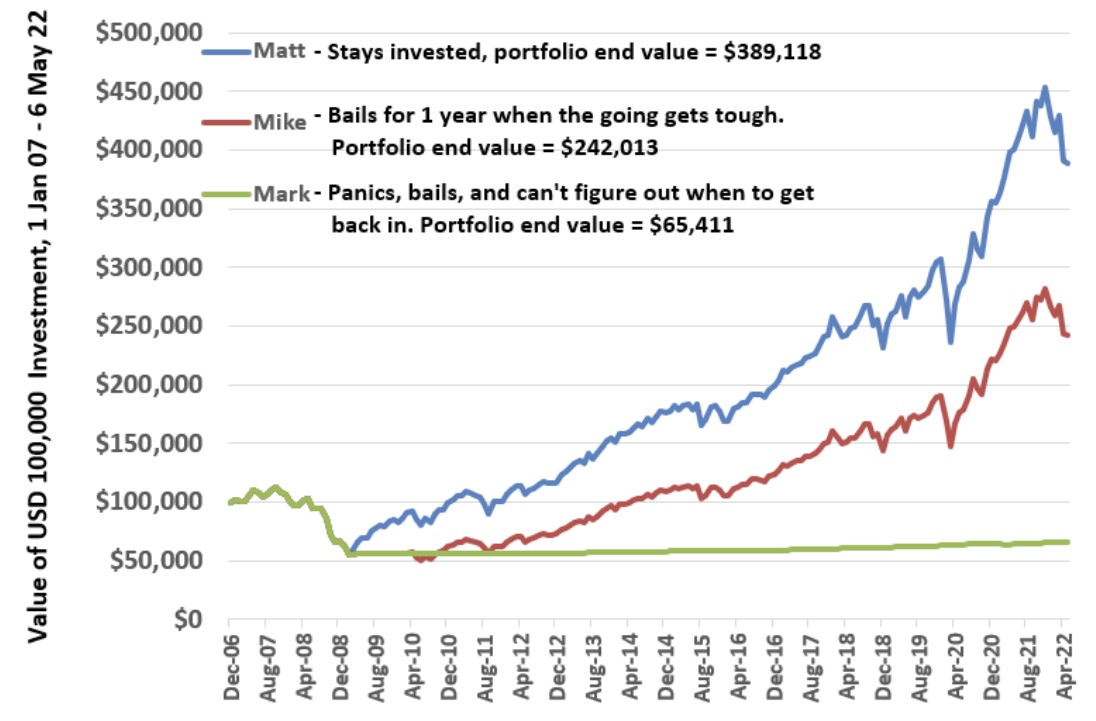

Evidence shows that it's far better to stay invested than to try to time a market correction and run the risk of missing a period of continued expansion. When you try to time the market, you'll find greed and fear working against you—many investors who cash out find they got out too soon and/or couldn’t judge when to buy back in and therefore stayed out too long. Take the following example where three investors had USD 100,000 invested in an S&P 500 exchange-traded fund (ETF) during the period 1 Jan. 2007–06 May 2022, which included the global financial crisis, the recovery that followed, and several downturns along the way.

The first investor, "Matt," stayed invested during the entire period. Although his portfolio value dropped to USD 51,372 at the worst point, in early March 2009, he stayed in the market and reinvested all dividends that he received. By May 2022, his investment is worth USD 389,118.

His friend "Mike" exited the market at the bottom (when the talking heads on cable financial networks said the S&P 500 would continue to fall) and invested in cash for a year. A year later, after learning how much better his friend Matt's portfolio was doing, he then re-entered the market and ended up with USD 242,013 by May 2022.

The third friend, "Mark," cashed out after the fall, wasn't sure when to re-enter, and didn't think the subsequent rally was justified. He stayed out of the market, vowed to remain in cash, and ended up with only USD 65,411 in May 2022.

Which Investor Will You Be?

The ups and downs that come with investing in a long-term portfolio that includes equity can be unsettling. However, it's important to remember that short-term uncertainty and market volatility come with the territory. Trying to hedge the volatility away or time the market will rarely work in your favor. Instead, strategies that do work include the following: Separate out cash you may need for the short term, remember that the long-term market trend is upward, and stick with your investment strategy. By following these basic principles, you're more likely to end up ahead of the game.

This article is a revised and updated version of one that had appeared previously on www.crevelingandcreveling.com.

Additional Resources:

Expat Investment Advice: Seven Things Expats Need to Know About Investing

Expat Investment Advice: Don't Chase Returns; Diversify Instead

Expat Investment Advice: The Cost of Not Sticking with Your Investment Strategy in Volatile Markets

Expat Case Study: Overcoming the Cycle of Greed and Fear in Investing

About Creveling & Creveling Private Wealth Advisory

Creveling & Creveling is a private wealth advisory firm specializing in helping expatriates living in Thailand and throughout Southeast Asia build and preserve their wealth. The firm is a Registered Investment Adviser with the U.S. SEC and is licensed and regulated by the Thai SEC. Through a unique, integrated consulting approach, Creveling & Creveling is dedicated to helping clients cut through the financial intricacies of expat life, make better decisions with their money, and take the steps necessary to provide a more secure future.

Copyright © 2022 Creveling & Creveling Private Wealth Advisory, All rights reserved. The articles and writings are not recommendations or solicitations, and guest articles express the opinion of the author; which may or may not reflect the views of Creveling & Creveling.