Expat Investing: Are Unrealistic Expectations Derailing Your Investment Plan?

By Chad Creveling, CFA and Peggy Creveling, CFA

We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. - Anonymous saying

The above often-repeated saying can be applied to many areas of life. When it comes to investing, we frequently see people overestimate what they can achieve in any given year and underestimate what they can achieve in the long term - often to their detriment.

Unrealistic short-term investment expectations can have a severe impact on your long-term investment plan and on your ability to achieve your financial goals. Two of the more common and pernicious investment mindsets we encounter among expats are "I want to beat the market" and "I expect an x% return each year on my portfolio." Neither expectation is rooted in reality or connected to the financial goals the investor is trying to achieve.

Often the result of an aggressive sales-driven financial service industry or an over-promising financial "advisor," such expectations often lead investors to take on excessive risks that result in disappointment, causing investors to hop advisors or investments in search of elusive returns. The result is often subpar investment performance at best.

"I Want to Beat the Market"

Expat investors often express investment goals such as "I want to beat the market." This is typically because they don't really understand what is possible and have heard the phrase somewhere, or they are looking for bragging rights with their buddies. But "beating the market" is not an investment plan, even if it were possible over the long run. It's difficult to see how a $50,000 investment that "beats the market" is in any way related to what may be the investor's genuine need, say to generate an inflation-adjusted income stream of $30,000 per year over a 30-year retirement period.

The other problem is identifying which market we’re talking about. If you’re in a globally diversified investment portfolio—which as an expat you should be to minimize investment risk—you’re exposed to numerous equity and fixed-income markets or benchmarks. By virtue of diversification, it would be impossible for your portfolio to beat all of them.

For example, if U.S. large cap stocks were the best performing asset class/market in a given year, and you had a 20% exposure to this asset class, there would be no way that your portfolio as a whole could "beat" the returns of this asset class, given that 80% of the portfolio was invested in asset classes/markets that were not the best for the year. Unless you are able to successfully predict which asset class/market will be the best each year throughout your 30- to 50-year investment time frame, by design your portfolio as a whole will always outperform some asset classes/markets while underperforming others. This reduces the "beat the market" mentality to a meaningless concept regarding long-term investing.

The 10% Return Fallacy

Another commonly stated (or unstated) investment objective is "I want x% return on my portfolio each year" - typically double-digit. Again, this is often because investors don't really know what is realistic, and so they repeat something they have heard. The assumptions that typically underpin this expectation are that returns can be earned evenly year in and year out and that those types of returns can be earned regardless of the investing environment. You can't really blame the investor for this, since the hyper-competitive financial service industry has been delivering this implicit message for years.

However, the reality is that investment returns do not occur evenly each year, and no one can successfully time the markets, predict the best asset class or investment, or earn a specific return each year over a 30- to 50-year investment period.

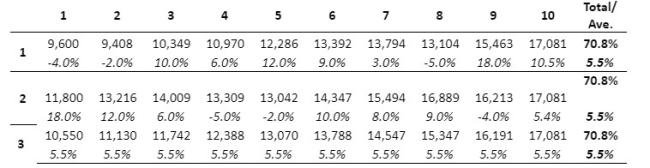

Many investors expect their returns to resemble the return sequence in the third row of the table below - only higher. In reality, annual investment returns are the result of a multitude of unpredictable factors and follow a somewhat random dance around a longer-term upward trend.

Different Sequences of Returns

An investor focused on the initial returns of the first return sequence in the chart above would surely be disappointed and would probably look to change investment strategies or find another advisor. Those receiving the second return sequence would certainly be much happier and conclude they had either a superior investment strategy or a great advisor. Yet both sequences result in the same 10-year total return of 70.8% and the same average annualized return of 5.5%. In fact, there are a large number of ways—about 3.6 million—that you can sequence the 10 annual returns, and they all have the same 10-year averages.

Different Sequences of Returns, US$10,000 Invested for 10 Years

Source: C&C estimates

The point is that there is little to no information in the first-year return number (or any one-year number) that indicates what your long-run average will be. For a properly diversified portfolio, a quarterly or annual return number is mostly noise, and an excessive focus on annual numbers coupled with unrealistic short-term expectations can cause investors to search for elusive results, often resulting in a destruction of investor wealth.

What Can You Expect?

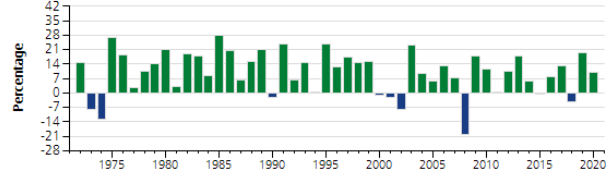

From 1972 to 2020, a moderate-risk, globally diversified portfolio averaged 8.9% USD per year before fund fees and taxes. This does not mean that the portfolio return was exactly 8.9% each and every year. In fact, the annual returns ranged from a low of -20.16% in 2008 to a high of 27.87% in 1985. For eight of those years, the portfolio returns were negative. Among the eight years with negative returns, there was one two-year period with negative returns and one three-year period of negative returns:

Annual Historical Returns (1972-2020)

Source: MGP, C&C estimates, Diversified Portfolio, Moderate Allocation

Typically, the annual returns ranged between -1.6% and 19.3%, but the returns fell outside that range in some years. The prior year's return yields little information about the next year's return, and no one year's return taken in isolation provides much indication of the 49-year average of 8.9%, which is an average calculated after the fact, not an annual target.

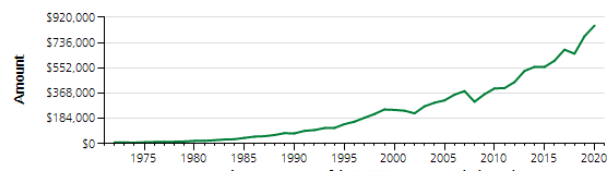

An investor who was able to withstand the many ups and downs of the market would have seen an initial investment of $10,000 grow to over $860,000 before taxes and fees during that time period.

Hypothetical Investment Growth 1972 - 2020

C&C estimates, Pretax, pre-fund fees

A Dose of Realism

Despite expectations or promises to the contrary, investing is never a smooth ride. For those with realistic expectations and the fortitude to endure the inevitable ups and downs of the markets, investing can result in significant wealth creation over time. Note that we are referring to a properly designed, globally diversified portfolio, not a single, undiversified, high-risk investment.

This article is a revised and updated version of an article that appeared previously on www.crevelingandcreveling.com.

Additional Resources

Seven Things Expats Need to Know About Investing

Expat Investing: The Importance of Sticking with Your Strategy in Volatile Markets

Expat Investment Advice: Don't Chase Returns, Diversify Instead